Any business that intends to accept payments by credit card or debit card must have a merchant account in order to validate customers’ card details securely and to make sure that there is enough funds to complete the transaction. Here at Business Quotes we compare card machines across a variety of brands and prices to find the best card reader for your small business.

You might find that the bank that provides your business account is also able to offer merchant account services, although it is likely that if your company is a small to medium enterprise, or a start-up, you will be able to find more competitive rates and prices from an independent service provider (ISO). It’s worth remembering that you don’t have to have a merchant account with the same bank that holds your company’s business account.

A merchant account is not the same as a business bank account. A merchant account is where the money is first sent to after you take a payment from someone. The merchant account will check that there is enough money in the bank account that the payment will come from. If there is enough money in the bank account the card payment will be accepted. If the payment is accepted the payment will be held in the merchant account and then sent across to your business bank account after a period of time known as the settlement period.

There are many different merchant account providers out there, and by getting more than one quote, you will put your business in a better position to find the best deal. There are set-up fees and charges per transaction with all merchant accounts, but these costs can vary considerably depending on the merchant account provider.

Our guide is designed to help you unravel all the information about merchant accounts and to help you find the best package for your business. We compare card machines to ensure you’re getting the best for your small business. By getting more than one competitive quote for merchant accounts from ISOs you can compare card machine prices and get the deal that will be of most benefit to your company.

Having a merchant account means that your business will be able to:

Any shop that doesn’t offer its customers the opportunity to pay with a credit or debit card is putting itself at a serious disadvantage. As we become less and less reliant on cash, even for small payments, it is inconceivable that any company which makes face to face transactions is not able to handle credit and debit cards. The fact that you will also be able to offer customers a cash-back option, only adds to the benefits you can provide.

Even service providers can get the edge on their competitors by offering clients and customers the chance to make simple and straightforward card payments rather than going through the inconvenience of cheques or bank transfers. Naturally, for any online retailer or service provider, being able to accept card payments is essential, making online merchant accounts advantageous.

Having a merchant account and the best card machine for a small business means that your business will have less cash and fewer cheques to deposit, cutting down on bank charges as well as the time that staff spend having to go to the bank. With online transactions, your business can enjoy the benefits of a smoother, more efficient system of accepting payment.

Paying with a credit or debit card is a fast and smooth process, and even online transactions are dealt with very quickly providing the payment service provider is not overloaded. (Learn more about Internet Merchant Accounts and payment service providers below.)

The reason why a merchant account is necessary for receiving card payments, rather than simply having the amount go directly to your business bank account, is to authorise the cardholder’s details and to make sure that the necessary funds are available to complete the transaction. By accepting payment from credit and debit cards rather than cheques, you minimise the risk of your company being subject to bad cheques.

With the convenience that card payments can provide, and the speed with which you will be able to process transactions, you will make it easier for your customers to spend more money with your company. This and the fact that people tend to spend more when they are paying with a card as opposed to cash, means that you can confidently expect to see an increase in sales when your merchant account is established.

Merchant account services are provided by all of the major banks, as well as ISOs that are usually able to offer more competitive rates to smaller businesses and start-ups. Different merchant accounts are needed according to the method of receiving payments. If you plan to accept payments both in-store and online, you will need two separate merchant accounts.

In order to set up a merchant account, your company will need to go through a validation process so that the merchant account provider can assess your company’s financial history and forecasts (see more about applying for a merchant account below).

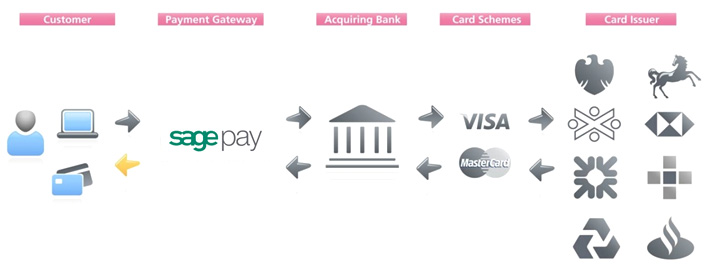

If your company plans to sell products or service online, it will need a dedicated merchant account, known as an Internet Merchant Account (IMO), as well as a website. IMOs also require a payment gateway, sometimes referred to as a payment service provider (PSP); this is because of the greater security risk associated with online credit card payments, PSPs provide an extra layer of protection for your company and increased security for the card holder. Again, banks offer PSP accounts, although independent organisations are able to offer more competitve rates.

If your small business already has a trading history, and has decided to start selling products or services online – and is able to forecast a high level of online card transactions – establishing an IMO is likely to be a fairly straightforward process. It can be more difficult for start-ups however, and one viable alternative is to use a payment processing company. These kinds of accounts can be set up immediately, and don’t require validation, making them an attractive option for companies with little credit history.

One downside with payment processing companies is that they hold on to the money for a long time, often for as long as two months, before passing it on to your company. If cash flow is a concern, this can present a serious problem. The other thing with payment processing companies is that on average the transaction charges are higher than with IMOs, although as the popularity of payment processing companies is increasing, these charges are steadily coming down.

The amount you can expect to pay for initial merchant account fees and transactions charges will vary depending on the size of your business and its financial history. We compare card payment machines prices right here. It is important to compare quotes from different suppliers before making a final decision on which bank or ISO to choose. Although there are costs involved in setting up a merchant account, as well as charges on every single transaction, it is worth remembering that the cost of NOT having a merchant account is likely to be considerably higher in the long run, due to loss of sales.

As well as the transaction fee, there are also minimum monthly service charges (MMSCs) and set up fees. For the activation or set up merchant account fees, you can expect to pay between £75 and £200. The MMSCs are between £10 and £30, and there might also be an annual charge. Transaction fees for credit cards are between 1.6% and 3%, while for debit cards the charges can be from 20p to 50p.

If you are setting up an IMO, the payment service provider is likely to have their own set-up costs as well as fees between 10p and 30p per transaction.

The differences between these fees can be considerable, and it is likely that your company will be charged according to its size and its financial history, as well as the forecasted rate of online transactions.

If you are planning to receive face to face transactions, there is also the fees for the equipment to consider. Generally, fixed, portable and handheld payment terminals can be rented as well as bought outright.

Once you have a merchant account you then need to consider which is the best card reader for processing payments for your business needs.

When you apply for a merchant account, it is likely that you will have to provide certain pieces of information in order for the merchant account provider to assess the level of risk your company represents. Each provider will have its own particular set of requirements, but it is likely that you will need to present a detailed explanation of your business and its products or services, your company’s accounts, average transaction amounts and forecasts, as well as references from suppliers.

If your small business is a start-up, or has a poor credit rating, contact the provider and ask if there is anything else that you can submit in order to support your application. It may be necessary for you to consider a risk reserve – where a lump sum is put to one side for a certain period of time while your business proves itself as reliable.

Due to the risks involved and the amount of checks that the provider will need to make, it can take about four weeks to get approval for a merchant account.